Tax Management Information System

| ✅ Paper Type: Free Essay | ✅ Subject: Economics |

| ✅ Wordcount: 2274 words | ✅ Published: 20 Aug 2018 |

Literature Review

Internet is a very powerful platform that connect people from all around the world. Taiwan has employed the Internet as an enabler to speed up public services online and has earned a top ranking worldwide for its achievements [14]. Almost all government agencies operate with internet facilities and have their own websites. IT is often perceived as the great enabler of service innovation [14].

As innovative of nature of government’s application of relevant technologies to service delivery remained unexplored, public sector need a framework that applies service innovation studies. Innovation is defined as the “implementation of a conscious process of change to gain certain effects or results” [14]. Innovation evaluation should be based on citizen satisfaction and the creation of citizen needs rather than in terms of profit making.

The basic principles of service delivery include the processes per see, co-operation, trust and social acceptance [14].We need to make the best use of the web’s potential as a means of improving public services will create innovation patterns in cyberspace. With introduction of e-government services, it will attract potential user to use the new delivery system.Public service sector is consider to be able to possess a distinctive style of innovation as these large organizations have higher shares of professional staff and conduct their own research and development.

There are five types of innovation which consist of Innovation involving changes in characteristics and design of service products and production process, delivery innovation, administrative and organizational innovations, conceptual innovation and system interaction innovations. All the five types innovations need a new way, new strategies, improved solution to be able to interact with other organizations and knowledge bases.

E-government initiatives use the Internet to reallocate private resources to public services [14]. In cyberspace, online services create new markets that differ from traditional services along two primary dimensions: the degree of service “separability” and the type of benefit offered [14]. The service must be produced and consumed at the same time.

The “separability” feature becomes the main difference between e-services and traditional services where the latter feature “interactivity” or are “co-terminal” [14]. Citizen can complete their payments procedures without leaving home. As a core benefit, citizen can complete multi-part task without the need to visit various government agencies, which eventually will save them a lot of time.

Government websites gave citizen greater accessibility to government information and greater convenience, while aiming also to overcome jurisdictional divisions through “seamless service” initiatives [14]. Single window format can accommodate an owner-delivered approach, shared delivery through integration or delegated delivery through an intergovernmental service utility. Area of focus are technology innovation, administrative innovation and new market creation. The portal cannot be considered as innovation if it only provides online information and forms for download [14].

Strength of market creation and website structure

This tells us that Government agencies need to bring their operation online with innovation in order to serve their citizen better in any possible way. Innovation is important in portal design structure as it will attract more citizen to join.

Tax Education in Distance Learning

Self assessment system (SAS) is introduced to educate taxpayer with fundamental tax knowledge. To determine tax liabilities, taxpayer need to comply with public rulings and tax law issued by Inland Revenue Board of Malaysia (IRBM). Taxpayer with tax knowledge will able to accurately assess their tax liability.

Tax education only applicable to accounting undergraduates. Undergraduates that are non-accounting, who are the future taxpayers need to be equipped with tax knowledge as well. This will enable them to be more confident in planning their tax affairs [15]. It will helps in improve voluntary compliance and reduce inaccuracy of tax return.

An online survey was conducted to collect data on whether Non-accounting undergraduates have sufficient tax knowledge and should they enrolled under the electronic distance learning program known as e-PJJ. Result shows that 45.2% fill their tax return by themselves while 54.8% need help from their spouse.

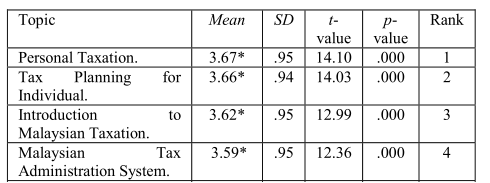

Result of Respondents level for score of Tax Knowledge

Types of instructional method was also in the survey question and the result shows most respondents prefer online learning than compared to traditional method of face to face learning. Online learning has the flexibility of time and place which best suits the working adults [15]. For topics that need to be covered in the tax education shows respondent interested to learn more about personal taxation and tax planning for an individual. They were aware of the importance of claiming reliefs, rebates and tax planning in computing their chargeable income and determining an accurate tax liabilities [15].

Result of Respondents preferred Tax Instructional Method

Result of Respondents preferred tax topics

All result shows that respondents need to be equipped with tax knowledge and to be aware of provision and changes in tax laws. Online tax education is much prefer by most respondent shows that traditional instruction method is no longer popular in era of technology. Online education is a must in order for future or current tax-payers to be equipped with the fundamental of tax knowledge so that they will be able to handle and determine an accurate tax liabilities.

E-Government in Australia

In Australia, National Electronic Conveyancing System (NECS) was introduced by Australian State and Territory Government in 2005. All conveyancing deal like conveyancers, legal practitioners, financial institutions, mortgage processors are available with NECS online. The system will allow users to provide, secure, certify and sign documentation [16].

NECS will serve as a useful model for other areas of commercial, governmental and social activity. This will allow Australian government may better achieve its strategic goals in developing a modern economy and remain among leaders in this area [16]. The purpose of NECS is to develop a national online conveyancing system. The issuance of Digital Signature Certificates issued under the Australian Government Gatekeeper Framework which will ensure authentication and prevent repudiation [16].

Reserve Bank’s Information and Transfer System (RITS) will get financial settlement with disbursements received and cleared for reuse. Duty and Tax Payments will be received electronically by The State and Territory Revenue Offices as cleared funds from settlement through National Electronic Conveyancing System.

Four stages involve in the development of NECS which are extensive stakeholder consultation, building the system with its protocols and features, all issues must be tackled to ready the system and conversion process must be ready for government, financial institutions and other participants to transfer what they want to do with new NECS system.

Five Frameworks were introduced which consist of Enabling legislation, Authorization issued by a JA to an ELNO, Operating Requirements, Participation Agreement and Participation Rules and Inter-governmental Arrangements. All the frameworks introduces were to provide the infrastructure upon which the promise of a more efficient, transparent and effective system of electronic conveyancing becomes a reality [16].

Australia NECS system will be beneficial to the citizen in the way when dealing with government. All possible issues had been tackle well when the system was implemented. The system is secure with digital signature which citizen won’t worried when transaction is being done through the system.

Design of Tax Management Information System

Tax income is very important for national economy. With the new tax system introduced, there will be conflicts between new and old taxation measures. It is necessary to establish a powerful, efficient, secure, stable, shared and controllable tax management information system to raise tax collection ratio, to enhance efficiency of the execution of tax law, to improve taxation service, and to reduce the taxation cost, so as to strengthen tax collection management, to provide high quality comprehensive service for taxpayers, and reliable reference for macro-economic decisions [17].

The content of system can be summarized as “one platform, two steps, three covers and four systems”. One platform means to develop a centralized technical platform with network hardware and software. Two steps means need to gradually realize the centralized data process in the state and provincial administration of taxation. Three covers means extend the system gradually cover all taxation items, tax management key parts and to be able to connect with relevant departments. Four systems is to develop four information management system respectively for main operation which consist of collection and exchange of information, administration and decision support.

Tax management information system include four organically-combined subsystems built on centralized technical platform which include tax management system. Tax management system mainly dealing with tax operations, internal and external tax administrative management, taxation decision system dealing with economic supervision, forecasting and analysis. Four subsystems consist of Tax operation system, Tax administrative management system, Decision support system and External information system.

Tax operation system includes six parts for inspection, collection, punishment, management, execution and relief. Tax administrative management system includes seven parts, documentary process, knowledge management, HR management, financial management, logistic guarantee, supervision an auxiliary office. Decision support system is mainly for inquiry, analysis, supervision and forecasting of tax management. External information system is mainly for collection and transmission of external information.

Operation flow of tax management information system

Tax management information system is an integrated system and will be designed on the basis of “one network, one platform and one set of data standard” [17].

General Framework of Tax Management Information System

All data can be shared with just single input and all operation will be display on a centralized interface, the assessment can be done thoroughly with the entire system. There are four implementation strategy of the system which include the strategy to assembling units and “building blocks”, to construct tax application system with three-layer structure, to construct a common data exchange platform and to construct scientific and reasonable common unit platform.

Three layer systematic structure

With introduced of new tax measures, an efficient, stable, secure and controllable tax management system need to be develop to improve taxpayer tax knowledge, enhance efficiency of execution of tax law, to improve taxation service and to provide high quality service to taxpayer. With three layer separation structure, it will minimize redundancy of data and functions and hence accurate and correct data can be delivered to taxpayer.

E-Tax Invoice System using web service technology in Thailand

Online Employment Management System Based on Data Mining

Graduate online Employment Management System is developed based on data mining. Research is mainly focus on management level and technical level. At management level, this system should be in accord with the application demand characteristics of college employment management; at technical level, this system should adopt an advanced and applicable software development mode and process [15]. The main objective of this system are centers on management demand, takes relatively perfect and prominent management function realization.

The development of information technology makes every aspect of the whole society located in the state of interacting information and meanwhile it faces the application requirements of reducing cost and improving management and service level and therefore choosing a suitable development mode should fully consider ever-increasing management and service demands [15].

SQL Server200 is chosen as database management system because it is the more popular enterprise database. The design and implementation of database are not merely a part of management information system and its functions are almost the core of management information system, because from management content, its core is data storage and management [15].

Database interrelated logic data set stored in certain organization way but it does not refer to the sum of several files. It implies the re-organization among data files and file records, it have relatively high independence of program, data and serves multiple users or applications programs in least repetition to realize data sharing.

Online Employment system based on Data Mining has various function which consist of user login, user management, data input, inquiry function, statistical function and database management.

Site Diagram of graduate online management system

Data is the core of system operation [15]. To ensure security of data, system has automatic data backup function at the server end. Artificial recovery is system administrators use new backup data artificially to recover data when server data is destroyed.

Graduate online management system makes a lot of repeated and miscellaneous work handled automatically and managed orderly by computer. The system ensure the consistency, accuracy and timeliness of data, provide real-time, dynamic, accurate and complete employment information, ensure college employment management quality and provide a highly digital, normalized and scientific employment management information and processing platform for colleges [15].

Online Montessori Management System

Easy Montessori Manager is developed for all the schools that are using Montessori approach in Malaysia. The objective of Easy Montessori Manager is to provide Montessori curriculums and modules which are fit inside this portal to help the teachers to monitor their children’s developments [14]. From survey collected, result shows there is a need to develop an online Montessori module system for teachers and principals of Montessori pre-schools in Malaysia [14]. The System EMM is developed specially for teachers and administrators of Montessori preschools. It has two main features, the Montessori module and the management module [14].

The Montessori methods cover three techniques, Motor education, Sensory education and Language [14]. The Montessori module contains the Montessori methods, the method guidelines, children performance analysis and progress report. The Management module contains features such as registration, timetables and attendance records.

This project methodology uses Rational Unified Process (RUP) as Software Engineering Process. It provides a disciplined approach to assigning tasks and responsibilities within a development organization. RUP goal is to ensure the production of high-quality software that meets the needs of its end-users, within a predictable schedule and budget [14].

Workflow of RUP

Easy Montessori Manager is divided into two modules which are Montessori module which provide child monitoring system and General Preschool Management System module that helps the school administrator, principals and teachers to manage the school administrations. This system act as a guideline for teachers and child monitoring system for parents.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal